At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.32% per year. These returns cover a period from January 1, 1988 through July 31, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return.

Nevada itself has been a hotbed for lithium deposits, but the sites have seen opposition, with conservationists, Indigenous Americans and even NASA pushing to block mining in the area. The rush to acquire the white gold has also been exacerbated by President Biden’s clean energy agenda, which calls for EVs to make up about 50% of all cars sold by 2030. Electric vehicle makers have bemoaned estimates that “white gold” supplies will fall short by 2025, with China, the US and several South American countries vying to locate large deposits to meet the increasing demand. The source of the lithium may be lithium-rich volcanically-derived Opal Spring hydrothermal fluids that were fed upward into the overlying sediments and poorly-lithified sedimentary rocks along northerly-, northeasterly-, and northwesterly-trending feeder faults. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index (Market Barometer) quotes are real-time.

However, following a slide from as much as $17.37 per share, back down to around $7.75 per share, AMSC stock could be on the verge of hitting prices that will make it a worthwhile long-term wager on greater demand for electricity in a post-carbon world. Paul A. Jacobson, GM’s chief financial officer, told investors mid-June that they “already have that risk” of not getting enough lithium, explaining that GM has bought stakes in mining operations. CAT received additional regular- and screen-fire bulk sample assays from samples taken from the Stag’s Leap porphyry (“PCD”) and diatreme exploration target on its Gold Jackpot claims.

Financial Calendars

LODE’s beta can be found in Trading Information at the top of this page. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market. As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style. The scores are based on the trading styles of Value, Growth, and Momentum.

There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities. One share of LODE stock can currently be purchased for approximately $0.44.

Zacks Earnings ESP (Expected Surprise Prediction) looks to find companies that have recently seen positive earnings estimate revision activity. The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season. The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. However, as Louis Navellier and the InvestorPlace Research Team have pointed out, what makes SOFI stock most appealing is its potential to blossom into a major financial institution, and not just in retail banking.

SoFi’s big move into IPO underwriting this month could enable it to give old school Wall Street banks a run for their money as well. But then, allegations about data manipulation set in motion an extended SAVA stock selloff. Since August 2021, the stock has fallen from around $120 per share, to just under $20 per share today. News the company may have discovered the largest deposit of lithium in the world.

Comstock Mining (LODE) Gets a Buy from Noble Financial

Comstock Mining Inc. is the stock du jour Wednesday, as it blasted higher more than fourfold on heavy volume to pace all premarket gainers. The mineral development and production company announced deals in which it secure… The Company’s 88% owned LINICO subsidiary also consummated the sale of 1,500 preferred shares, or 4%, of its 37,162 Green Li-ion Pte. Ltd. (“Green Li-ion”) shares for gross sales proceeds of $0.8 million, and a realized gain on the sale of approximately $0.6 million, and effectively valuing the remaining 35,662 shares at about $19 million.

- It allows the user to better focus on the stocks that are the best fit for his or her personal trading style.

- The Style Scores are a complementary set of indicators to use alongside the Zacks Rank.

- In fact, when combining a Zacks Rank #3 or better and a positive Earnings ESP, stocks produced a positive surprise 70% of the time, while they also saw 28.3% annual returns on average, according to our 10 year backtest.

- Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams.

Yet while this lithium stock in the past has received boosts from “EV mania” more so than from “meme mania,” shares earlier this week did receive a pop, thanks to a sharp spike in speculation. A new product launch just this week could serve as a growth catalyst as well. Meme mania may never return for BB shares, but the stock nonetheless could bounce back thanks to improving fundamentals. With this, let’s take a look at seven past and present favorites of the Reddit set, each of which should be one of the best meme stocks to buy right now. However, even as the stocks that sparked this investing phenomenon in early 2021 has retreated to more rational prices, a crop of new stocks have experienced meme waves of their own so far this year. “They have always been and continue to be a top tier strategic technology and business partner and we very much look forward to their continued success.”

What is Comstock Inc’s stock style?

Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer. The next big run may take some time, yet with shares pulling back in recent weeks, now may be an ideal time to start building a position. These catalysts may not get MRNA back to its high-water mark (over $400 per share), but even a partial recovery would represent big gains compared to present price levels.

Comstock’s stock is owned by a number of retail and institutional investors. Top institutional investors include Geode Capital Management LLC (0.68%), Renaissance Technologies LLC (0.52%), BlackRock Inc. (0.42%), Spire Wealth Management (0.32%), State Street Corp (0.19%) and Northern Trust Corp (0.13%). The company is scheduled to release its next quarterly earnings announcement on Monday, October 30th 2023.

Quotes & News

“We look forward to putting this capital to very productive use in our other lines of business, including our new photovoltaic recycling facility located in Silver Springs, Nevada.” High-growth stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, opting for reinvestment in their businesses. More value-oriented stocks tend to represent financial services, utilities, and energy stocks. In time, trends like mass adoption of electric vehicles, as well as decarbonization of electricity production, point to increased sales for American Superconductor’s products. Once the company scales up to the point of profitability, forget about AMSC merely re-hitting its recent meme high.

Click the link below and we’ll send you MarketBeat’s list of the 10 best https://1investing.in/ stocks to own in 2023 and why they should be in your portfolio.

Have Insiders Sold Lode Resources Shares Recently? – Simply Wall St

Have Insiders Sold Lode Resources Shares Recently?.

Posted: Tue, 05 Sep 2023 20:11:28 GMT [source]

Comstock Inc is engaged in technologies that efficiently use wasted and under-utilized natural resources to produce renewable energy and other products that contribute to balancing uses and emissions of carbon and enhance mineral and material discoveries. It operates through Renewable Energy, Metals and Mining, and Strategic and Corporate Investments segments. The company produces aviation, and marine fuel; carbon neutral ethanol, oil, gasoline, renewable diesel, and other renewable replacements.

Comstock Q1 2023 Earnings Call

Within the McDermitt Caldera (an ancient volcano), there may be 20 million to 40 million metric tons of lithium. Belgian geologist Anouk Borst said that if the estimate proves true, the sudden overabundance of American lithium — the metal sought after by electric vehicle makers — could have global impacts. A lithium deposit discovered in a volcanic crater along the Nevada-Oregon border may hold up to 40 million metric tons of the rare metal — possibly the largest ever in the world, which could have a massive impact on the electric vehicle industry, according to a new study. It is interpreted that the high Pb and Zn values are indicative of a Pb-Zn halo above a PCD/Diatreme intrusive-related body containing Cu-Au-Ag-Te mineralization.

It also shows CAT’s claims in relation to the approximate claim locations of Gli, Surge and Peloton Minerals Corporation, the Company’s neighbours in what is considered to be a new and emerging lithium discovery area. The Idavada Volcanics (Tts) tuffites-ignimbrites-sediments overlie the Jarbidge Rhyolite and Humboldt Formation sequences on the north side of the Opal Springs Fault. Previous geologic mapping by Coats shows the Opal Springs fault going through the area of CAT’s new northern claims.

In addition, it is involved in design, engineering, fabrication, procurement, and construction solutions; and third-party license services, as well as produces lithium, graphite, nickel, cobalt, copper, aluminum, and other metals. Further, the company engages in metal processing, mine development, environmental and reclamation operations, and mining services; sells metals, and leases mineral properties. The company has collaboration agreements with Mercury Clean Up, LLC for the manufacture and deployment of mercury remediation systems. Comstock Inc. was incorporated in 2008 and is based in Virginia City, Nevada. CAT Strategic Metals’ corporate strategy, as reflected in its overall Mission Statement, is to source, identify, acquire and advance property interests located in mineral districts proven to have world-class potential, primarily lithium, tellurium, gold, silver and copper. CAT’s shares trade on the Canadian Securities Exchange (CSE) under the trading symbol “CAT”, and on the Frankfurt Stock Exchange under the symbol “8CH”.

CAT is investigating if it was a feeder fault for lithium mineralizing hydrothermal fluids. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Markets

These surface samples contained local elevated gold, copper, tellurium, and lead to in excess of 0.4% Pb. The geochemically-anomalous areas are shown in Figures 2, 3, 4, and 5 for the outline of this previously-identified (in 2009) zone of widespread surface mineralization. North is up on these figures, and the grid boxes are 500 by 500 meters each. In addition, CAT staked six (6) new lode claims for lithium in the NW part of its work area, contiguous with its existing Jackpot Lithium claims, and 3 more claims contiguous to the SW. The northern claims are along the northern boundary of the Opal Springs rhyolite flow dome-(caldera?), which post-dates the Jarbidge Rhyolite. The Jarbidge Rhyolite is of a similar age as the rocks of the McDermitt sequence that holds the giant Thacker Pass lithium deposit.

Sericitized, pyritic quartz-feldspar porphyry dikes are present immediately to the south of this highly mineralized area. The widespread high copper and gold values over a wide area atop this target could mean that a body of PCD/Diatreme mineralization could be present at a shallower depth than previously thought. An IP survey atop this target by Zonge Geosciences for CAT showed an anomalous zone of electrical conductivity at an undetermined depth. Figure 1 below shows CATs original claim block in blue and its 41 new claims in red.

Even if a deal doesn’t materialize, Blackberry has a few other catalysts on tap. Not only that, even if the top two meme names are performing poorly and have questionable future prospects, other stocks boosted during the initial “meme mania” may just well be in the buy zone at current prices. Dividend commercial loan meaning yield allows investors, particularly those interested in dividend-paying stocks,

to compare the relationship between a stock’s price and how it rewards stockholders through dividends. The formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price.

This site is protected by reCAPTCHA and the Google

Privacy Policy and

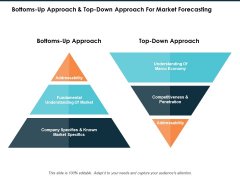

Terms of Service apply. We’d like to share more about how we work and what drives our day-to-day business. Our Quantitative Research team models direct competitors or comparable companies

from a bottom-up perspective to find companies describing their business in a

similar fashion. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. The Zacks Industry Rank assigns a rating to each of the 265 X (Expanded) Industries based on their average Zacks Rank.

Marshall Berol, co-manager of the Encompass Fund, said during an appearance on “Your Money with Chuck Jaffe” that gold and silver will continue to climb from their record levels, and that the stock market rally is likel… On the date of publication, Thomas Niel did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines. It all has to do with the long-term growth prospects for this fintech/neobank. Lately, much of the focus with SoFi has been about its student loan refinancing business.

Commenti recenti